Insurance

Fraud & Scams

Don’t Be a Victim: Beware of Insurance Fraud and Scams

Cunning fraudsters have perfected their skill and work daily to take advantage of well-intended insurance consumers who want to protect their assets. All consumers are impacted by insurance fraud and scams, even if not directly targeted. The Coalition Against Insurance Fraud estimates that at least $308.6 billion in fraudulent claims payments are made annually. Who ultimately pays for insurance fraud? All of

us!

As a result of insurance fraud:

- insurance companies may increase premiums to offset the loss

- the cost of goods and services may increase

- the insured property may be unnecessarily damaged or not repaired properly

Protect yourself from these insurance fraud schemes and scams below.

- Misrepresentation of Insurance by Agent

- Policy Cancellation

- Unlicensed Agent

- Repair

- Staged Auto Accidents

- Fraudulent Medical Charges

- Medical ID Theft

- Offers to Sell or Increase Coverage During a Disaster

- Unlicensed Contractor

- Employer Misrepresentation

- Reporting Fake Injuries

GENERAL INSURANCE SCAMS

Misrepresentation of Insurance by Agent

Misrepresentation occurs in many forms but the most common is misleading you to believe more coverage is available or the coverage period is longer. It occurs often with short-term or limited benefit health insurance plans. Misrepresentation also occurs when non-insurance products are presented as insurance, such as discount medical plans.

Consumer Tips:

- Only purchase and make changes to your insurance policy through a licensed insurance agent or your insurance company directly. Verify identity before making any payments or providing personal information.

- Review and ensure you understand any documents or contracts before signing.

- Be sure that your insurance company or agent is licensed to do business in Florida.

To Verify an Insurance Company License:

Office of Insurance Regulation

Active Company Search

www.FLOIR.com/CompanySearch

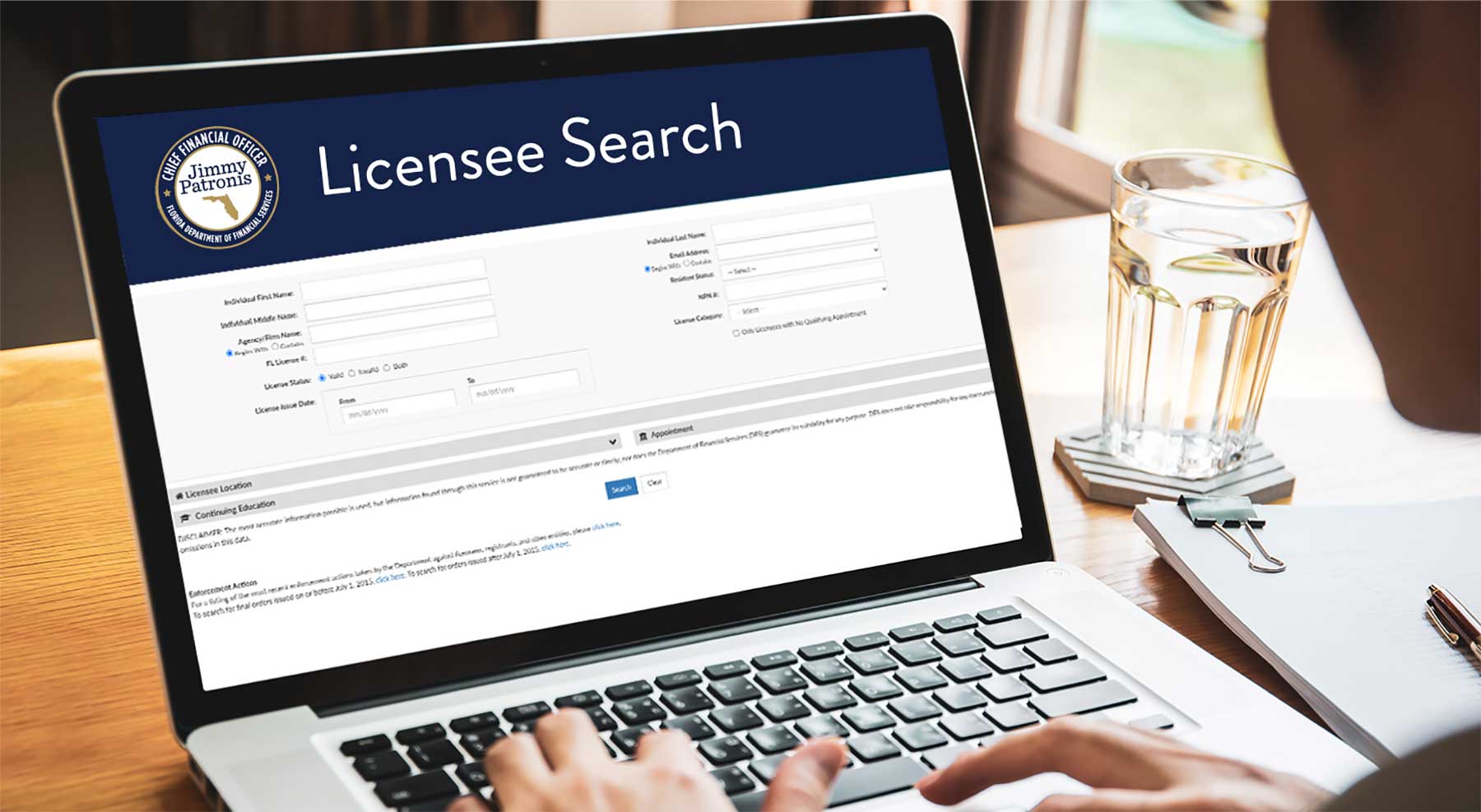

To Verify an Insurance Agent License:

Florida Department of Financial Services

Division of Insurance Agent and Agency Services

www.MyFloridaCFO.com/Division/Agents

850.413.3137

Policy Cancellation

A person(s) contacts you and pretends to be an insurance agent or representative from the insurance company and threatens to cancel your coverage if specific personal information or actions are not taken.

Consumer Tips:

- Purchase and make changes to your insurance policy through a licensed insurance agent or your insurance company directly. If you feel your coverage has been or will be canceled, contact your insurance agent or insurance company immediately. Verify identity before making any payments or providing personal information.

- Be leery of unsolicited calls. Companies should not call you unsolicited requesting personal information or ask you to verify details of your insurance coverage.

- Do not trust the caller ID. While the name and number may appear to be that of an insurance company, it may be a scam artist attempting to obtain your personal insurance information.

Unlicensed Agent

An agent who is not licensed by the Florida Department of Financial Services or not authorized to sell insurance for a specific insurance company. If you purchase a policy from an unlicensed or unauthorized agent, the policy is not valid and you will not have coverage.

Consumer Tip:

- Be sure that your insurance company or agent is licensed to do business in Florida.

To Verify an Insurance Company License:

Office of Insurance Regulation

Active Company Search

www.FLOIR.com/CompanySearch

To Verify an Insurance Agent License:

Florida Department of Financial Services

Division of Insurance Agent and Agency Services

www.MyFloridaCFO.com/Division/Agents

850.413.3137

AUTOMOBILE INSURANCE SCAMS

Repair

Unnecessary repair(s) or pretending to repair a vehicle in order to file a fraudulent or inflated insurance claim or to access your personal information. This type of scam also occurs with homes and other property.

Consumer Tips:

- Check with your insurance company before making repairs to your vehicle, home, etc. to ensure you follow policy guidelines and policyholder obligations.

- Verify that repair companies/vendors are legitimate, and have the proper liability and workers’ compensation insurance coverage.

To Verify Workers’ Compensation Coverage:

Florida Department of Financial Services

Division of Workers' Compensation

www.MyFloridaCFO.com/Division/WC

850.413.1609

Staged Auto Accidents

A person(s) intentionally causes or stages an automobile accident in order to file fraudulent or inflated insurance claims with your insurance company for repairs, injuries, etc.

Consumer Tips:

- Document as many details of the accident that you can recall to share with law enforcement and your insurance company. Details may include your potential speed, traffic conditions at the time of the accident, presence of traffic lights or stop signs at the location and if applicable, any behavior of the other vehicle before the accident (example: trailing you closely before the accident).

- Retrieve as much information, including contact and insurance information, from the other driver, if possible.

- Let law enforcement and your insurance company know if you have any suspicion the accident may have been staged or caused intentionally. Be sure to include any details that support this suspicion.

HEALTH INSURANCE SCAMS

Medical ID Theft

A person uses your identity and insurance to obtain medical services or prescriptions.

Consumer Tips:

- Don’t allow anyone to use your insurance card for services or to make fraudulent insurance claims.

- Check your credit report to ensure no one has opened new lines of credit in your name for the purposes of receiving medical care, i.e. credit cards that specifically cover medical or dental procedures. Visit www.AnnualCreditReport.com to review your free credit report.

- After receiving medical claims, your insurance company may provide you with an Explanation of Benefits (EOB), which is an overview of all of the services or prescriptions billed, fees that the insurance company paid on your behalf and your financial obligations. It also lets you know that the company has processed your insurance claims. Review your EOB to ensure no unauthorized medical services or prescriptions are listed or were billed to your insurance company. If there are unauthorized entries, contact your insurance company immediately.

Fraudulent Medical Charges

A medical provider charges for services that were not performed or falsely inflates the cost of services in order to file fraudulent insurance claims with your insurance company and receive payment.

Consumer Tips:

- After receiving medical services, your insurance company may provide you with an Explanation of Benefits (EOB), which is an overview of all of the services or prescriptions you received, fees that the insurance company paid on your behalf and your financial obligations. It also lets you know that the company has processed your insurance claims. Review your EOB to ensure no unauthorized medical services or prescriptions are listed or were billed to your insurance company. If there are unauthorized entries, contact your insurance company immediately.

- Don’t allow anyone to use your insurance card for services or to make fraudulent insurance claims.

HOMEOWNERS INSURANCE SCAMS

Offers to Sell or Increase Insurance Coverage During a Disaster

Consumer Tips:

- Be leery of unsolicited calls. Companies should not call you unsolicited requesting personal information or ask you to verify details of your insurance coverage.

- Do not trust the caller ID. While the name and number may appear to be that of an insurance company, it may be a scam artist attempting to obtain your personal insurance information.

- Purchase and make changes to your insurance policy through a licensed insurance agent or your insurance company directly. Verify identity before making any payments or providing personal information.

Unlicensed Contractor

A person represents themselves as a licensed, professional contractor when, in reality, they have not been licensed by the Florida Department of Business and Professional Regulation.

The unlicensed “professional” may also misrepresent their workers’ compensation and/or liability insurance coverage to give the impression that they are properly insured.

Unlicensed contracting work is illegal and dangerous for you, as a consumer. Using an unlicensed contractor can put you at risk of receiving unsatisfactory, subpar repairs, which could potentially cause more issues in the future or even cause severe injury to you or someone visiting your property.

Consumer Tips:

- Verify the contractor's license status with the State of Florida to ensure they are licensed and in good standing.

To Verify Contractor License:

Florida Department of Business and Professional Regulation

www.MyFloridaLicense.com

850.487.1395

- Verify that contractors and repair companies are legitimate, and have the proper liability and workers’ compensation insurance coverage.

To Verify Workers’ Compensation Coverage:

Florida Department of Financial Services

Division of Workers' Compensation

www.MyFloridaCFO.com/Division/WC

850.413.1609

- Review ICA Carter's Demolish Contractor Fraud: Steps to Avoid Falling Victim initiative to learn how to identify contractor fraud and protect yourself from becoming a victim.

WORKERS' COMPENSATION INSURANCE FRAUD

Employer Misrepresentation

An employer can commit workers' compensation insurance fraud by intentionally not providing appropriate coverage to their employees. This can occur by the employer:

- Under reporting the number of employees in the company.

- Misrepresenting job duties performed by employees that would otherwise require an increase in coverage and premium.

Consumer Tips:

Before joining a company, verify with the Department of Financial Services that the employer has workers' compensation coverage. Then, verify the coverage is up to date on an annual basis.

To Verify Workers’ Compensation Coverage:

Florida Department of Financial Services' Division of Workers' Compensation

Division of Workers' Compensation Proof of Coverage Database

850-413-1609

If you have any concerns regarding an employers workers' compensation insurance coverage, please contact the Division of Workers' Compensation:

Florida Department of Financial Services' Division of Workers' Compensation

Workers' Compensation Exemption/Compliance: 1-800-742-2214

Reporting Fake Injuries

Workers' compensation insurance scams perpetuated by an employee occur when an employee files a claim for a fake injury or pretends to be more injured than they actually are.

Consumer Tips:

Remember that claiming to be injured or purposely exaggerating injuries in order to claim workers' compensation benefits is insurance fraud. Workers’ compensation fraud is a third-degree felony that can result in fines, civil liability and jail time.

- Ensure that all information you submit on a workers' compensation insurance claim is completely factual.

- Do not let anyone else encourage you to report a fake injury or claim to be more injured than you are. You will be the one held responsible for insurance fraud.

- If you suspect a coworker or other individual is committing insurance fraud by faking an injury or the extent of an injury, report it immediately to the Florida Department of Financial Services:

DFS Fraud Hotline: 1-800-378-0445

Online: Criminal Investigations Division, Bureau of Workers' Compensation Fraud

- To learn more about workers' compensation insurance: Florida Department of Financial Services' Division of Workers' Compensation Consumer Education Materials

Review the Coalition Against Insurance Fraud's Infographic for more information on the impact of workers' compensation fraud.

INSURANCE FRAUD AND SCAMS GUIDE

Contact Your ICA

Florida's Insurance Consumer Advocate

Office of the Insurance Consumer Advocate

200 East Gaines Street, Tallahassee, FL 32399

Phone: (850) 413-5923

Email: YourFLVoice@MyFloridaCFO.com