The information on this page is for Government Employers that are not currently participating in the Florida Deferred Compensation Plan. For Employers currently participating in the Plan, additional resources can be found at MyFloridaDeferredComp.com/EmployerResources.

What is a Government Employer?

Section 112.215(2), Florida Statutes (2024), refers to Government Employers as "the state or any governmental unit of the state, including, but not limited to, any state agency; any county, municipality, or other political subdivision of the state; any special district or water management district, as the terms are defined in s. 189.012; any state university or Florida College System institution, as the terms are defined in s. 1000.21(9) and (5), respectively; or any constitutional county officer under s. 1(d), Art. VIII of the State Constitution".

What is the Florida Deferred Compensation Plan?

Commissioned in 1982, the Florida Deferred Compensation Plan helps more than 90,000 current and former employees, to save for retirement and invest in the future. The Plan was initiated as an opportunity to allow State of Florida employees to invest and save more towards retirement, as a supplement to the required Florida Retirement System (FRS). Now, all of Florida’s Government Employers are eligible to join, including State, County, City, Special Districts, Water Management Districts, and more!

The Deferred Compensation Plan is separate from the FRS and is completely voluntary. The Plan is designed so each Participant can save at a comfortable pace while benefitting from tax sheltered investing, with both 457b Pre-Tax and 457b Roth payroll contributions.

Key Benefits Offered to Employees

- Easy to understand fee structure and low fund expense fees

- Excellent investment options, including Fixed Accounts, Target Date Funds, numerous Mutual Funds, and a Self-Directed Brokerage Account

- Penalty-free account modification, such as contribution change, investment reallocation, and Investment Provider addition/replacement

- 457b Pre-Tax and 457b Roth payroll contributions are allowed

- Consolidate other eligible retirement accounts

- Dedicated customer service and professional investment performance oversight from the Bureau of Deferred Compensation and the Plan’s Investment Providers

- Immediate vesting

457b Pre-Tax Payroll Contributions

- Payroll contributions that lower taxable income

- Distributions taxed as income

- Penalty-free withdrawals after 31 days of separation from employment

457b Roth Payroll Contributions

- Post-tax payroll contributions

- Qualified distributions are not included in gross income

- 457b Roth qualified distribution rules apply

State of Florida 457b Plan vs Other Plans

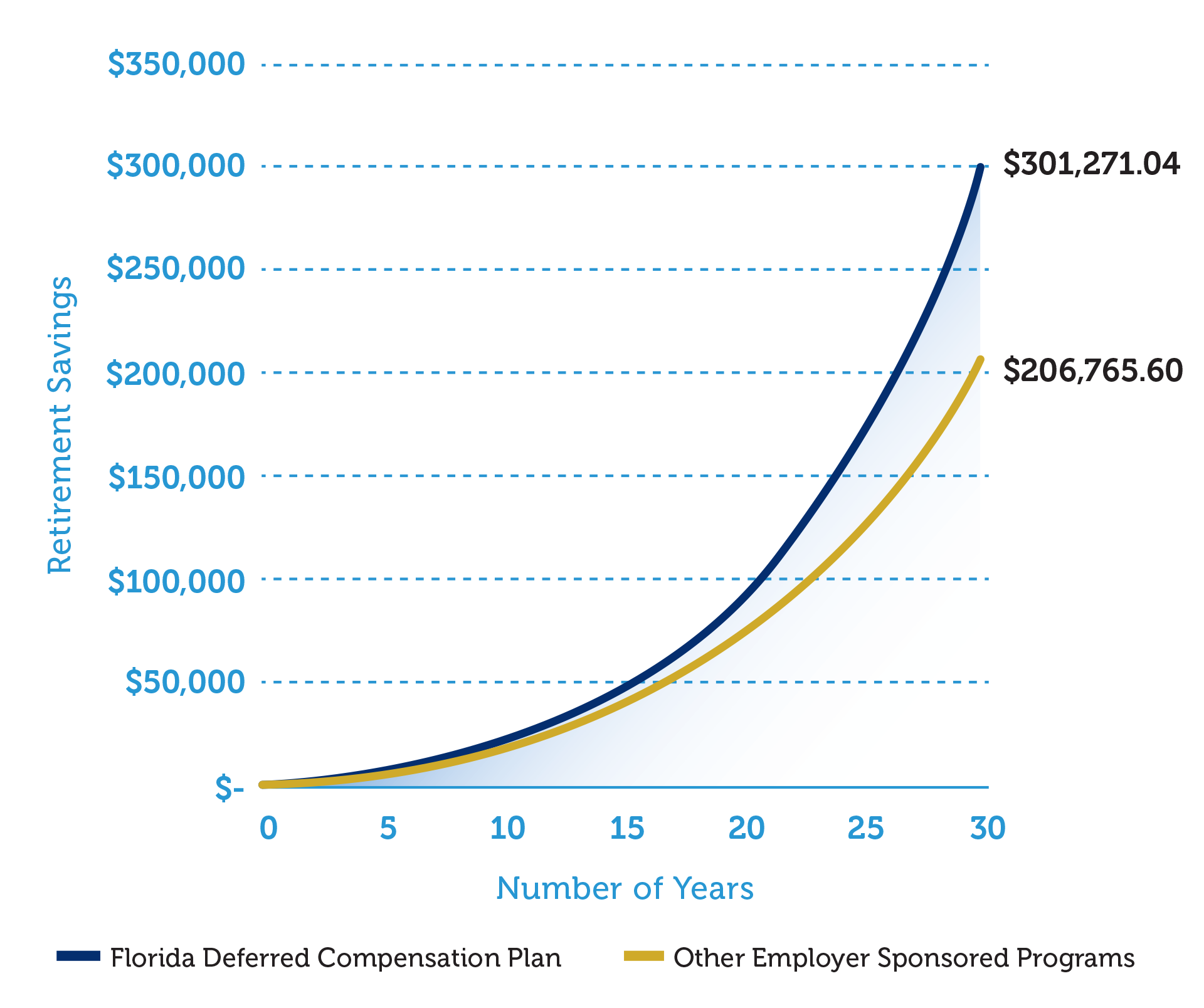

This graph shows the 30-year growth of a $100 monthly contribution in the T. Rowe Price Growth Fund available in the Florida Deferred Compensation Plan (with a 0.0825% administrative fee) versus the same fund offered to a other employer sponsored programs (with a 1.5% administrative fee). This graph uses actual 10-year average returns (as of 9/30/2022) to estimate growth of account value over time.

State of Florida 457b Plan

- Bureau of Deferred Compensation is the Plan Administrator

- Investment oversight by the State

- Pre-Tax and Roth payroll contributions

- Participants choose between Corebridge Financial, Nationwide Retirement Solutions, and/or Voya Financial

- Fixed Accounts, Target Date Funds, and Mutual Funds

- Self-Directed Brokerage Account

Other Plans

- Government Employer is the Plan Administrator

- Investment oversight by the Government Employer

- Fewer Investment choices

- Typically higher expense fees

- Limited customer service

Three Ways to Join the Plan

Add the State of Florida Deferred Compensation Plan: If you have one, you may choose to keep your current supplemental retirement plan active and offer the State of Florida Deferred Compensation Plan as the or an additional option to your employees.

Transition to the State of Florida Deferred Compensation Plan: You may choose to close your current supplemental retirement plan and roll existing assets into the State of Florida Deferred Compensation Plan.

Close Current Plan to Future Contributions: Another option is to close your existing supplemental retirement plan to future contributions, allowing employees to retain their existing assets while offering new contributions through the State of Florida Deferred Compensation Plan.

Employer Consultation & Plan Comparison

The Florida Bureau of Deferred Compensation can assist by providing an Employer Consultation. This consultation can be used to learn more about the Florida's 457b Plan and gives Employers the opportunity to invite decision makers to the conversation and ask questions about the Plan.

If requested, an Employer Consultation may include a comparison of Florida’s 457b Plan to the current employer sponsored retirement plan(s) offered to any Government Employer’s employees. For a Plan Comparison, it is most helpful for you to provide enrollment information, service disclosures, and performance reports detailing historical returns and expense ratios.

Email the Bureau Chief, Rosemary Isham, at Rosemary.Isham@MyFloridaCFO.com for more information about a Employer Consultation and/or Plan Comparison.

Joining the Plan Has Never Been Easier!

Step 1: The Government Employer must provide a Letter of Intent to join the Florida Deferred Compensation Plan.

Step 2: The Bureau of Deferred Compensation establishes a secured connection for the transfer of payroll files.

Step 3: The Bureau of Deferred Compensation provides banking instructions, secured connection credentials, and access instructions.

Step 4: The Government Employer tests the secured connection.

Ready to Join the State of Florida Deferred Compensation Plan?

Government Employers should submit a Letter of Intent to indicate interest in joining the State of Florida Deferred Compensation Plan. The letter should be on agency letterhead and contain the information included in the Letter of Intent template below.

View Letter Template

This website is intended to provide information about the State of Florida's Government Employees Deferred Compensation Plan. It is not intended as investment, legal, or accounting advice. If investment advice or other expert assistance is required, the services of a competent professional should be sought. For changes to your account, go to your Investment Provider's website and log in using the ID and password you created for that Investment Provider.

b13a956682094057a8451dfa3c2e7177.png?sfvrsn=ceb2720_1)