WHAT IS THE "ACTIVE PARTICIPATION CAMPAIGN"?

The Active Participation Campaign is an ongoing effort to strengthen the partnership between the Bureau of Deferred Compensation and Participating Government Employers.

Each quarter, Government Employers will receive an email from the Bureau to assist in supporting employee educational efforts. If you want to participate in the Campaign, please fill out the Employer Mailing List Form*.

* If you've already signed up for the Employer Mailing List in the past, no action is necessary, and you will receive the campaign emails.

GOVERNMENT EMPLOYER ACTION STEPS

- Set agency goals to increase participation. Aim for 5 percent, 10 percent, 20 percent.

- Determine ways to recognize or incentivize employees who take the time to learn more about their retirement benefits, including the Deferred Compensation Plan. Consider providing a certificate, authorizing casual dress days, or handing out agency swag.

- Share the link to our website: MyFloridaDeferredComp.com. The Bureau is happy to review website and publication content about the Florida Deferred Compensation Plan, should you want to add information directly to your agency’s published content.

- For those employers that utilize People First, incorporate the Florida 457(b) Pre-Tax and Roth Deferred Compensation Plan training to your New Employee Orientation/Onboarding schedule, as well as the *NEW* DROP into Deferred Comp Training.

- Order Publications to give out to employees by using the Printed Publications Request Form at MyFloridaDeferredComp.com/EmployerResources. Alternatively, PDF versions of Publications can be found at MyFloridaDeferredComp.com/Publications.

- Share the Events Calendar with employees to let them know about events hosted by the Bureau of Deferred Compensation and its Investment Providers (Voya, Nationwide, and Corebridge).

- Know the Investment Provider's Representatives in your area, and allow them to schedule a site visit at your agency for one-on-one appointments with employees (NOTE: Only the listed representatives are authorized to speak to employees about their Florida Deferred Compensation Plan account).

- Schedule an Educational Workshop for your employees with the Bureau of Deferred Compensation from the Employer Resources page. Educational workshops are tailored to fit the needs of your employees. Workshops can be virtual or in-person and are provided at no cost (based on availability).

- Attend our Spring Employer Training Workshop or Fall Employer Training Workshop, scheduled for April 16, 2026 and September 10, 2026. These are great opportunities to connect with the Bureau and stay informed. These events are offered twice, annually, in-person and virtually. For more information and to register, view the Spring 2026 Florida Deferred Compensation Plan Employer Training and the Fall 2025 Florida Deferred Compensation Plan Employer Training events.

- Share and use one (or more) of the Retirement Tools on our Investment Providers’ websites:

- The Corebridge Savings Center can help you meet your financial goals with a clear, actionable strategy. Creating a financial plan of action is the first step toward reaching your short-, mid-, and long-term goals.

- Nationwide has a Peer Comparison Tool that enables employees to see how much people like them are contributing and saving for retirement, and how their progress stacks up against peers.

- Learn what type of investment portfolio may "best" match certain investment personalities with Voya’s Investor Type Tool.

- Talk about retirement readiness. Have one-on-one conversations with your employees. Employees are more likely to engage when you are engaged.

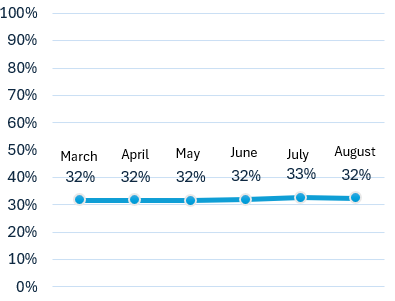

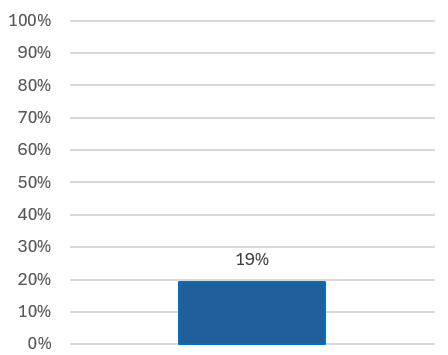

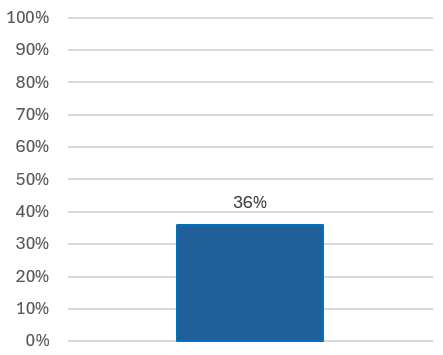

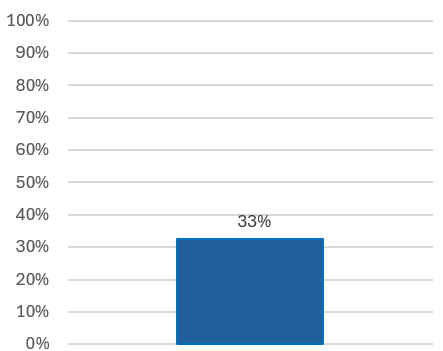

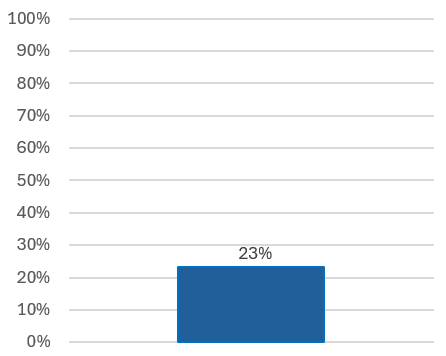

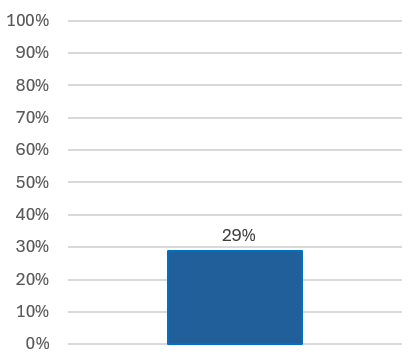

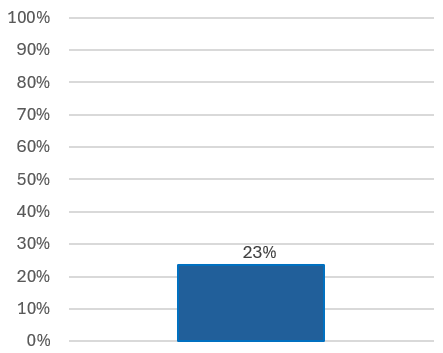

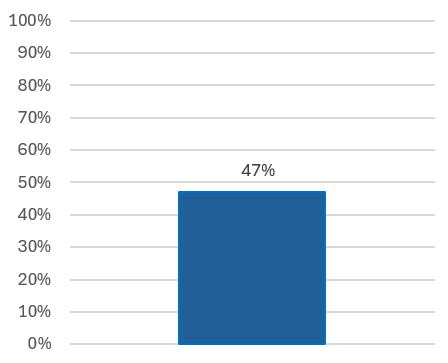

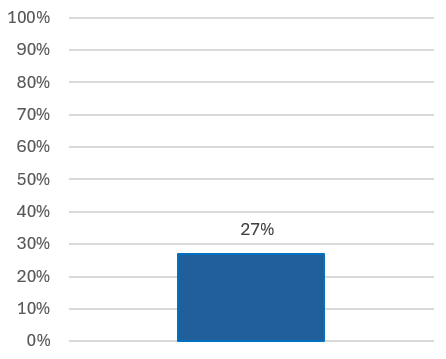

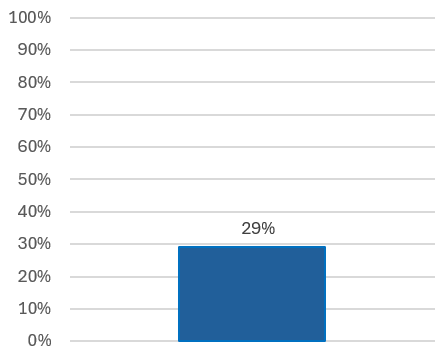

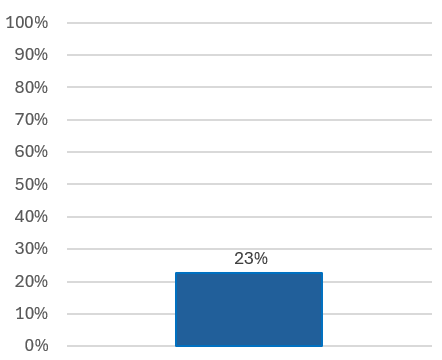

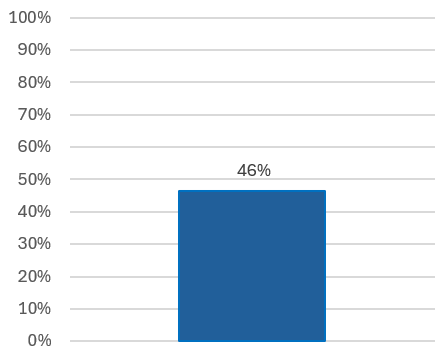

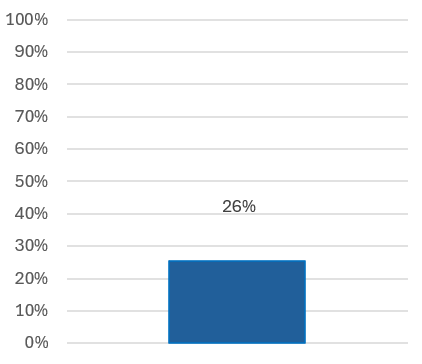

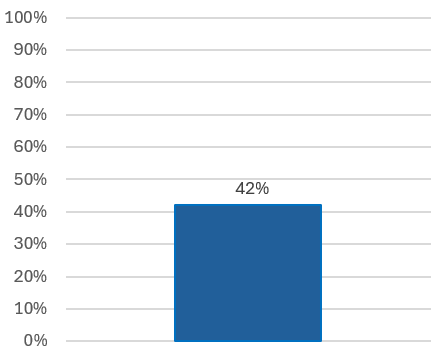

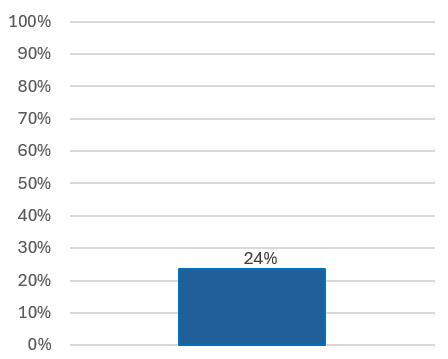

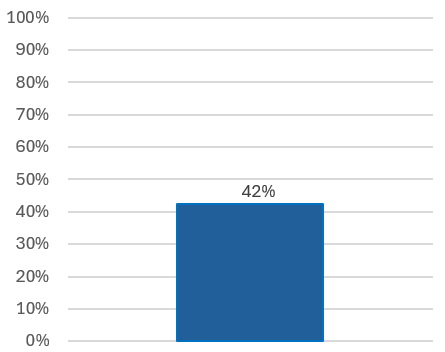

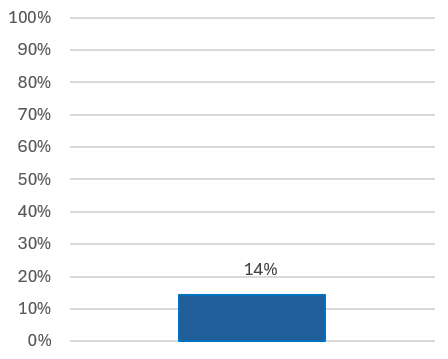

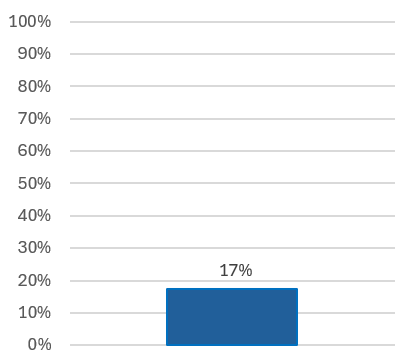

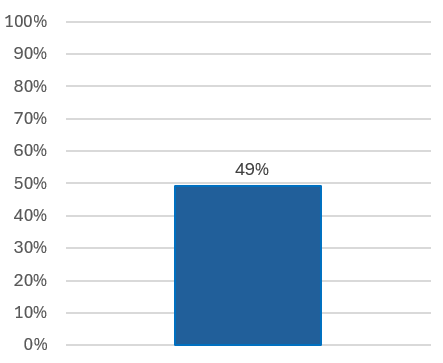

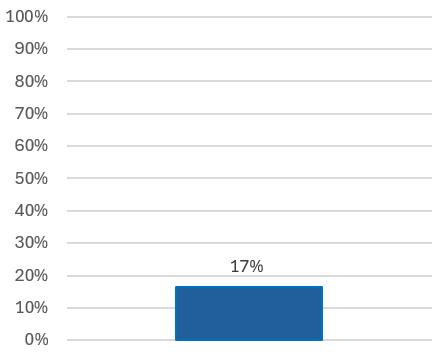

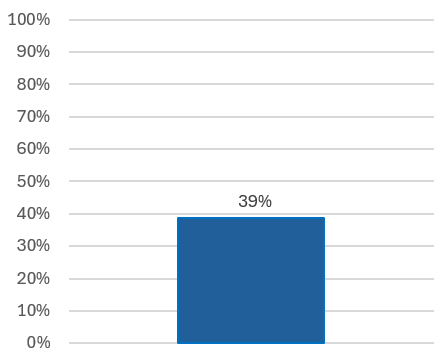

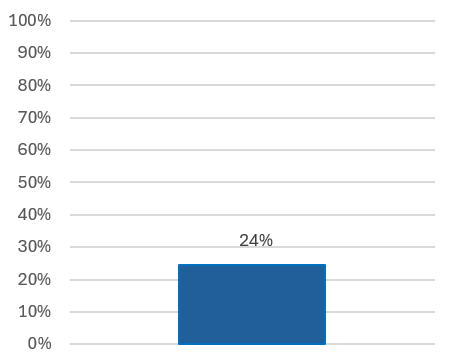

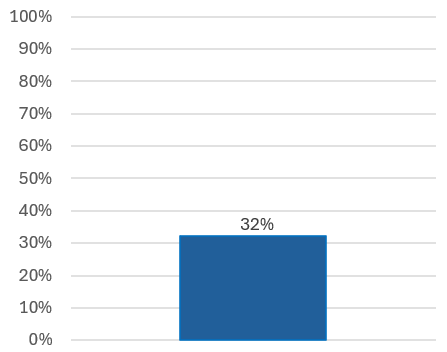

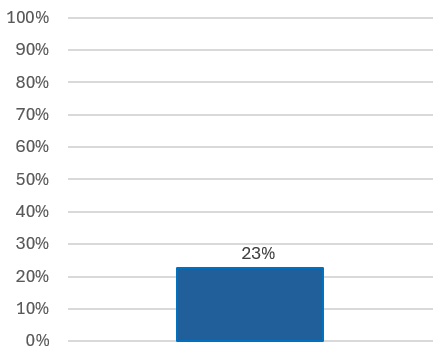

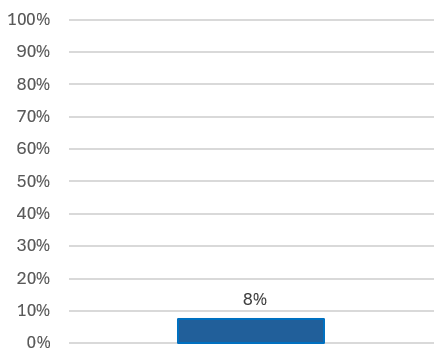

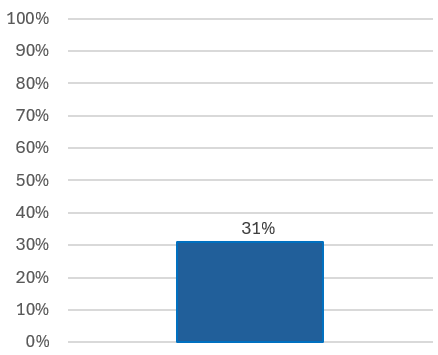

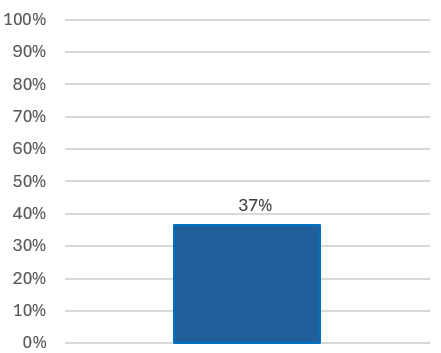

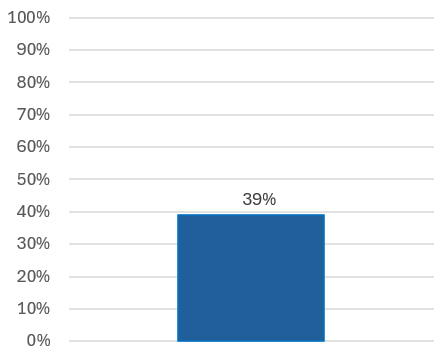

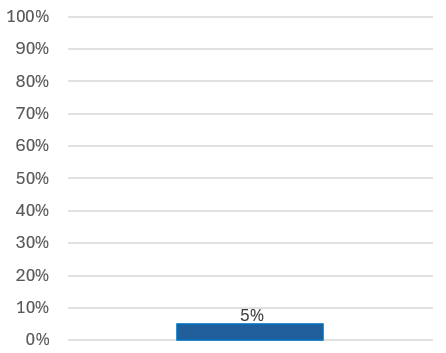

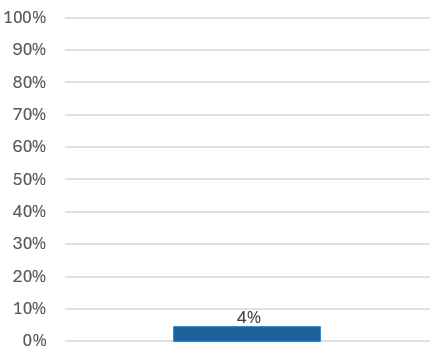

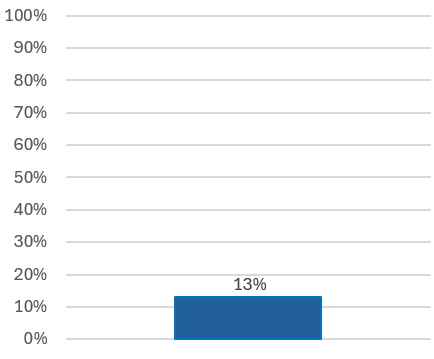

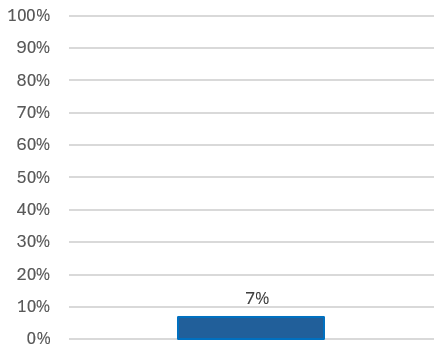

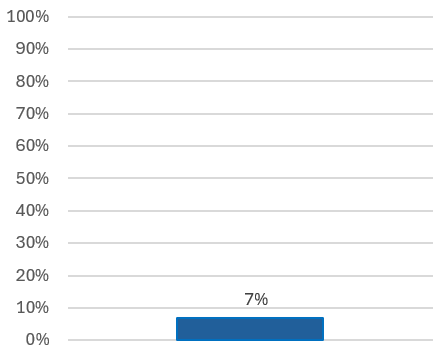

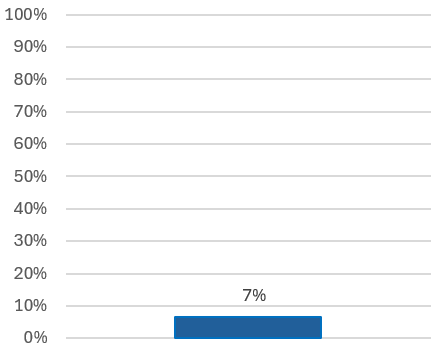

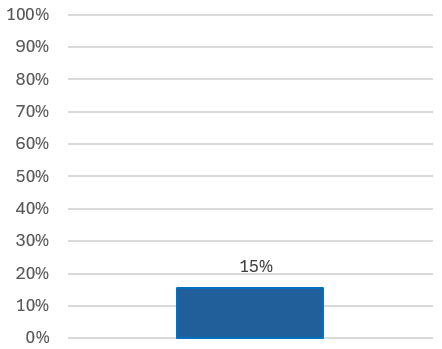

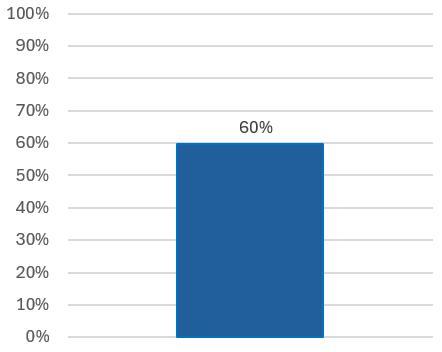

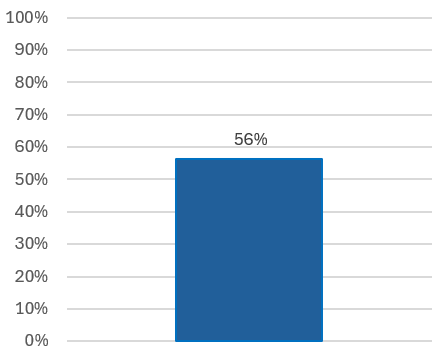

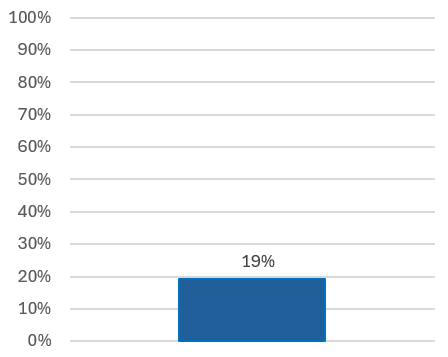

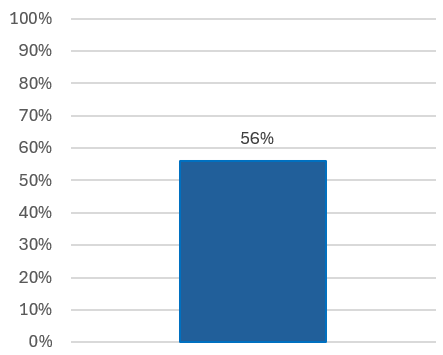

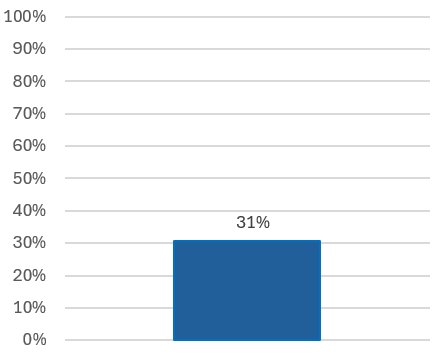

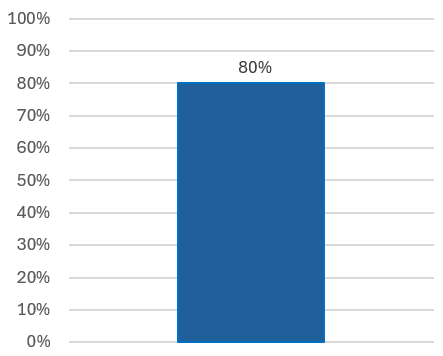

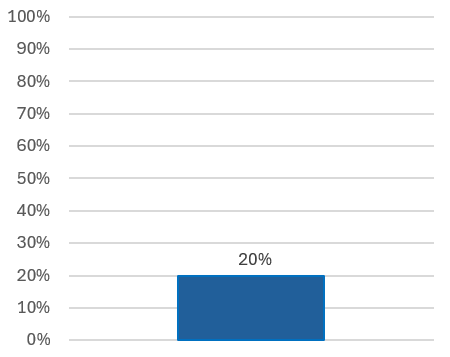

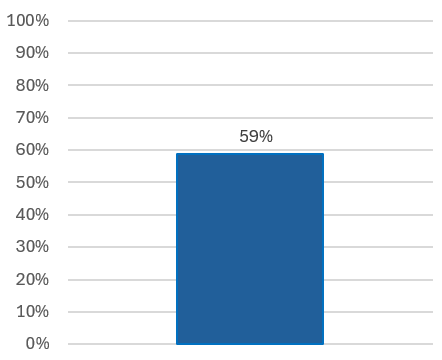

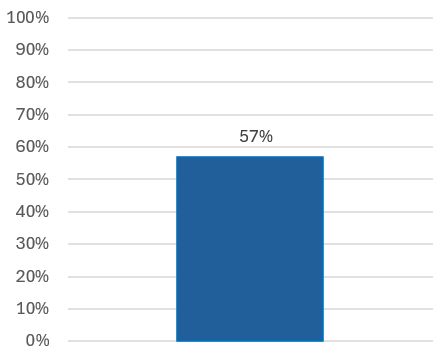

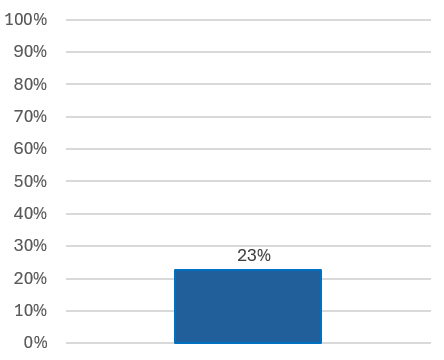

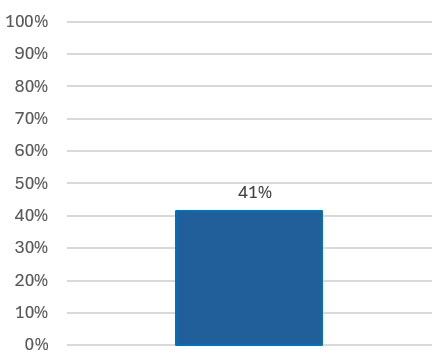

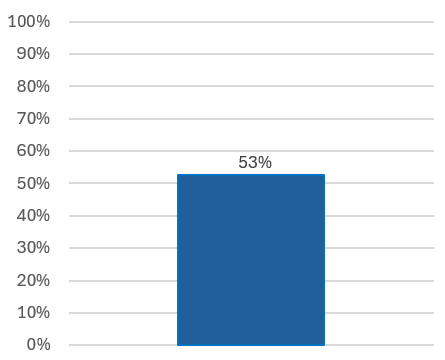

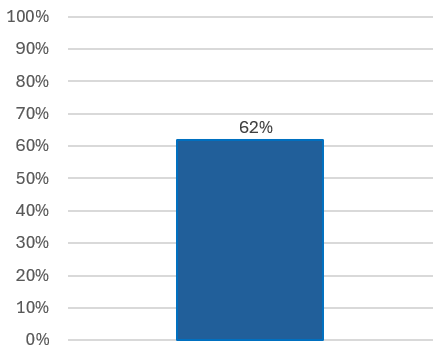

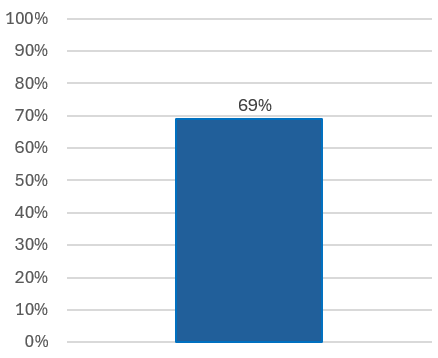

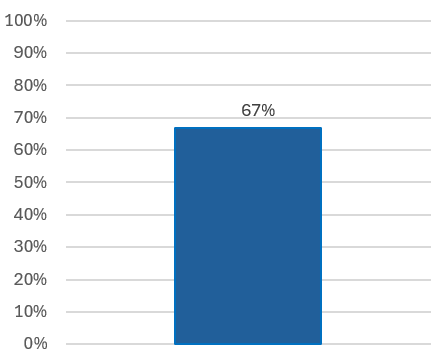

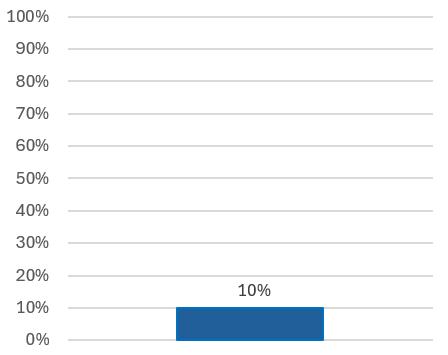

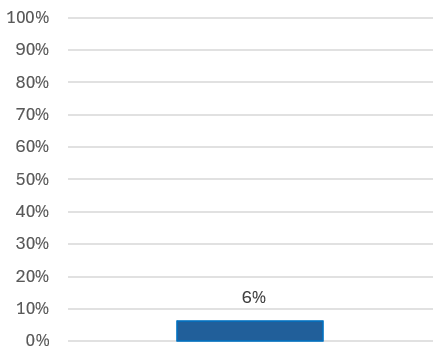

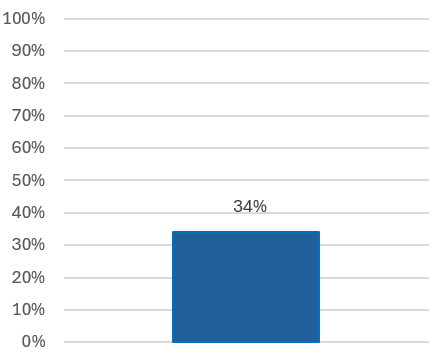

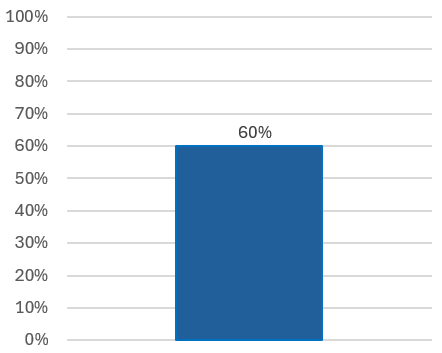

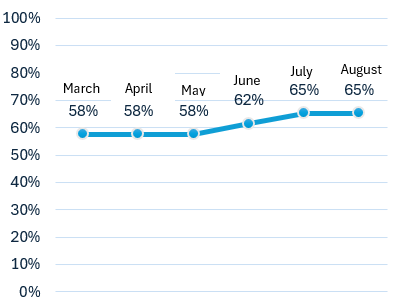

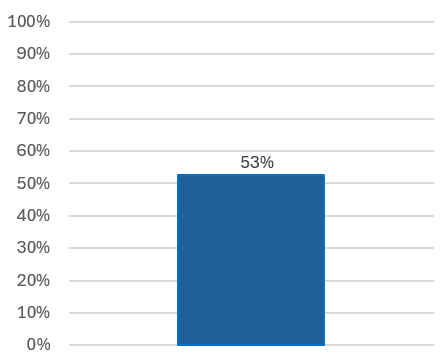

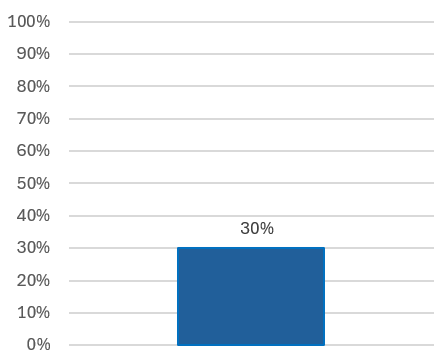

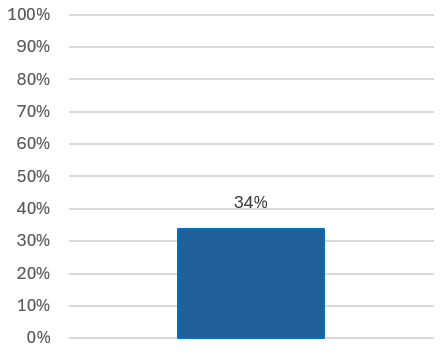

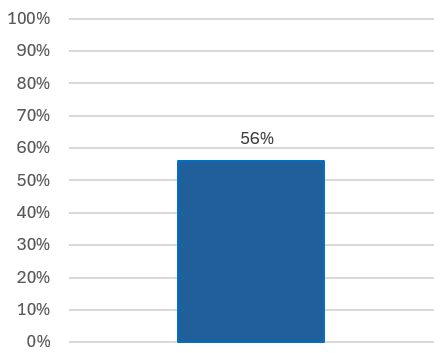

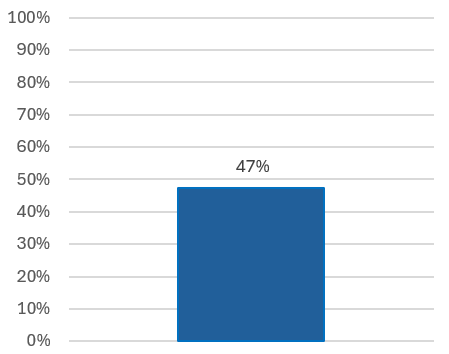

Click on your State Agency, University/College, or Special District/Other Government Employer to view the Active Participation* in the Florida Deferred Compensation Plan.

* The data represented by the graphs below are estimated based on the actively contributing Participants at the time of data collection. Participants not making an active contribution in the month prior are not represented. Not all participating Government Employers are represented below.

STATE AGENCIES

UNIVERSITIES / STATE COLLEGES

SPECIAL DISTRICTS / OTHER GOVERNMENT EMPLOYERS

This website is intended to provide information about the State of Florida's Government Employees Deferred Compensation Plan. It is not intended as investment, legal, or accounting advice. If investment advice or other expert assistance is required, the services of a competent professional should be sought. For changes to your account, go to your Investment Provider's website and log in using the ID and password you created for that Investment Provider.